Landlord failed to protect

your tenancy deposit?

Landlords have a responsibility to protect the deposit of tenants who rent under an Assured Shorthold Tenancy (AST) agreement. They need to do this within 30 days of receiving the deposit, using one of the three government-approved protection schemes.

If a landlord fails to protect your deposit correctly and on time, you might be entitled to compensation. This compensation can be up to three times the value of the deposit if you’ve already left the property or four times if you haven’t yet received your deposit.

If your tenancy has been renewed but your landlord still fails to protect your deposit, you may be entitled to bring additional claims and seek additional compensation.

These schemes are authorised by the government and are the only schemes your landlord can use to protect your deposit.

If you started or renewed your tenancy in the past 6 years and your deposit wasn’t protected using one of the schemes mentioned above, you have the right to make a claim. Additionally, you can make further claims for any subsequent breaches.

When you sign an assured shorthold tenancy agreement, your landlord will request a deposit. This deposit cannot exceed the cost of 5 weeks’ rent. After receiving the deposit, your landlord has 30 days to protect it using one of the three approved schemes. Once the money is safeguarded, your landlord must notify you where the deposit is being held and provide a reference number for the account. This ensures that your deposit remains secure throughout your tenancy and that your landlord cannot make any unreasonable deductions.

Your landlord is only permitted to access your deposit and make deductions under specific conditions. To do this they must inform you beforehand and provide evidence that the deduction is reasonable. Should your landlord neglect to do so, you have the option to bring a claim. You do not need to still be a tenant to do so.

You can claim if:

Awards for tenancy deposit dispute cases can reach up to three times the deposit amount. This means a £500 deposit could be worth £1500, plus a refund of the initial £500 deposit.

If your tenancy has been renewed but your deposit still wasn’t protected, you can claim for each renewal. This further increases the amount of compensation you could receive.

No, at The Brief Claims we operate tenancy deposit claims on a no-win, no-fee basis. This means you have nothing to pay unless and until you are successful. If your case is unsuccessful, you won’t pay us a penny.

Our fees are recovered from the defendant (your landlord) when we win, along with a modest success fee from your compensation. This gives more people access to justice without worrying about funding what could otherwise be an expensive legal case.

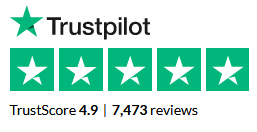

At The Brief Claims we excel in defending tenants against unlawful landlords. We have a proven record of securing compensation and believe in putting people before profits. Our no-win, no-fee agreements help ensure everybody has access to legal support regardless of their financial circumstance.

We examine all cases to make sure they have a good chance of success and provide a free initial consultation before a claim is accepted.

The tenancy deposit is the money you pay in advance of moving into a property. Sometimes known as a ‘security deposit’. The exact amount allowed to be charged depends on the overall yearly rental price.

No. You can only bring a claim in relation to a tenancy/security deposit.

The majority of private tenancy agreements in the UK are automatically classed as assured shorthold tenancies. Any private rental agreement starting since 1998 is likely an AST.

Your tenancy agreement is likely not an AST if;

– your tenancy was agreed to before 1998

– your rent is higher than £100,000/less than £250 per year

– if your tenancy agreement is with a local council

– the agreement was for a business premises

Your landlord should return your deposit no later than 10 days from the date you request your deposit, following the termination of your tenancy.

Your landlord is limited in what they’re allowed to deduct from your deposit, as technically it is still your money, and is only being held by your landlord. If any deductions are made, they should inform you and provide evidence of the cost. Only issues that have cost your landlord money can be deducted from your deposit, such as unpaid rent and damage to the property.

If you paid a tenancy deposit at the start of your tenancy, you are legally entitled to get it back when you leave. Your landlord can deduct money from your deposit under certain circumstances, though they should have informed you of this and provided evidence of the cost. If you believe that your landlord has made a mistake or unfairly made deductions from your deposit you can contest this.

Your landlord cannot charge you an additional fee for the protection of your deposit. Any insurance and membership fees associated with the deposit protection scheme should be paid for by the landlord.

Your landlord must place your deposit into one of three protected government-backed schemes within 30 days of receiving it from you. They must also inform you once this has been done and give you details of the scheme.

If you have unpaid rent, we will need to speak to you before we can make a decision on whether to accept your case. You may still be able to make a claim, depending on the amount of rent owed and the deposit paid.

If you are no longer a tenant at the property, you can still make a tenancy deposit claim. It will also deny your landlord the ability to threaten you with eviction in response. You can launch a claim up to 6 years from when your tenancy began and when your deposit was paid.

We do require evidence that your deposit was paid to your landlord at the start of your tenancy. There are many ways you can give this evidence, including a bank statement, or a receipt.

The Tenancy Deposit Scheme is one of the three authorised deposit protection services operating in the UK under government legislation.

MyDeposits is one of the three authorised deposit protection services operating in the UK under government legislation.

The Deposit Protection Service is one of the three authorised deposit protection services operating in the UK under government legislation.

If you can send across a copy of your tenancy agreement, we will be in a much better position to investigate your claim and find out how much compensation you may be awarded.

Section 21 notices cannot be issued if the landlord failed to use one of the three approved deposit schemes, and any eviction would be unlawful.

Every tenant deserves to know that their deposit is protected. If your landlord has failed to do so, we will help you make this right and get the compensation you deserve.